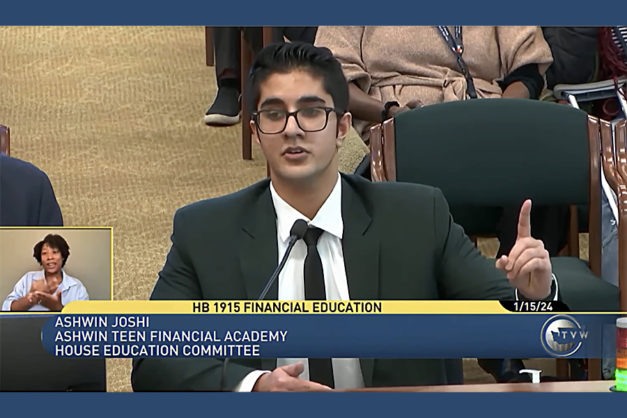

Enhancing Financial Literacy Education for Massachusetts Students

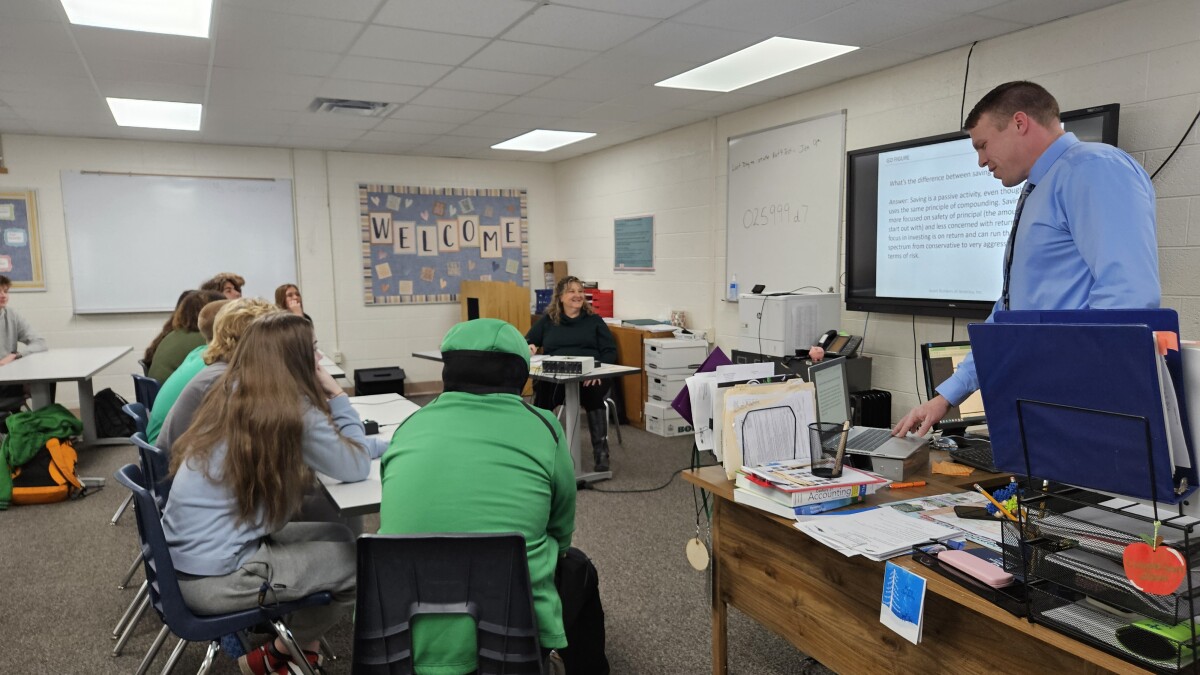

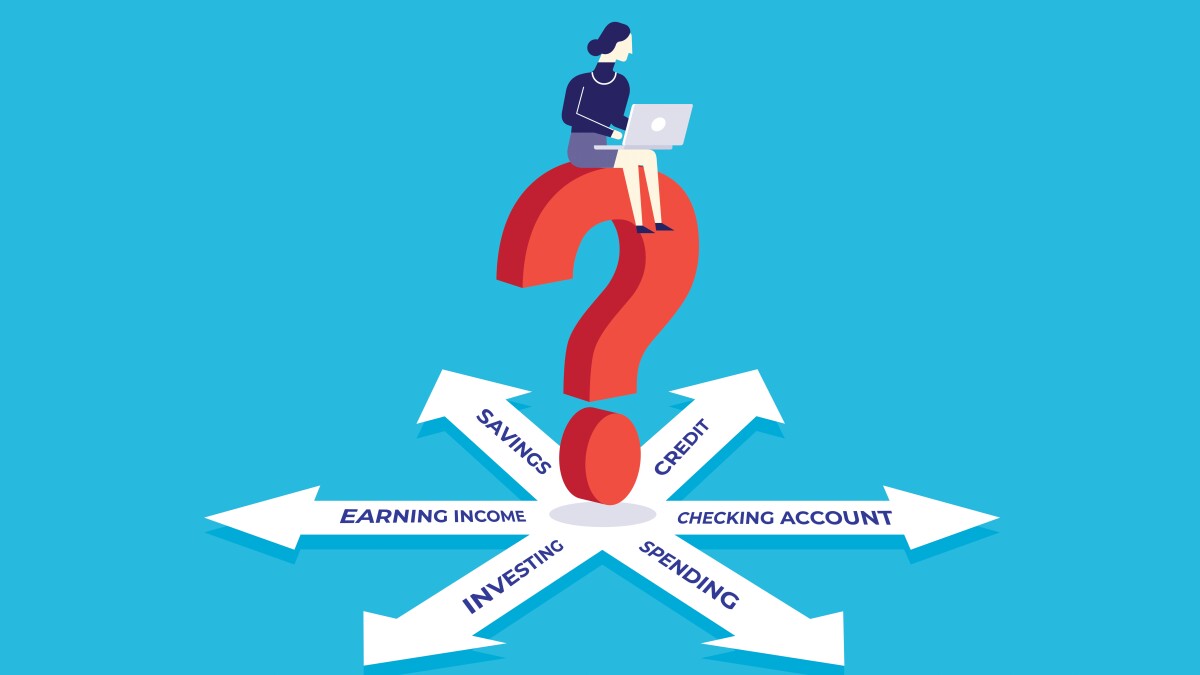

Given the soaring prices of goods and services across virtually every aspect of our economy, those equipped with a heightened understanding of how our financial system works stand the best chance o…